Key highlights:

- The Stablecoin of Binance, BUSD, was under-collateralized in its early days and lost its price peg more than once.

- Binance’s proof of reserve reports is under the scrutiny of government agencies and competing exchanges.

- Various individuals are making claims that BNB Smart Chain is a centralized blockchain.

The biggest crypto exchange acknowledged that its stablecoin BUSD had experienced under-collateralization and de-peg issues. According to Bloomberg’s report released this week, more than $1 billion in collateral was lost at different times due to early problems in BUSD. The stablecoin BUSD, developed in collaboration with the Paxos Trust, has lost its peg to $1 several times.

As stated by Binance, the de-pegging problems were short-lived and were caused by operational delays. No client’s funds were adversely affected due to these problems. Stating that a department is working to prevent peg from deviating, Binance stated that BUSD did not perform flawlessly in its early days. However, the world-leading exchange, which has since developed so many solutions for the protection of the $1 stable, has maintained stability for a very long time.

Binance is Under Government Control

Binance, which has come under public scrutiny regarding the collateral after submitting its proof-of-reserve reports, is forced to make some confessions about its products, BNB and BUSD. Binance, which has the largest market share among cryptocurrency exchanges, is trying to be cornered by both its competitors and public regulatory bodies. After Binance announced its proof of reserve using the Merkle tree method, Kraken co-founder Jesse Powell implied that the exchange had deliberately misrepresented.

CEO of Binance, CZ, said that these comments were ongoing FUD operations and that the news should not be heeded. On the other hand, Patrick Tan, who describes himself as “General Counsel for ChainArgos, a blockchain analytics company made famous for breaking the story that BUSD was unbacked periodically, and CEO for Novum Alpha,” claimed that BNB Chain and BNB Smart Chain are very centralized blockchains, contrary to popular belief. Tan focuses on under-collateralization. Also, according to Tan, some types of transactions on the BNB Chain are not kept in the blockchain explorer.

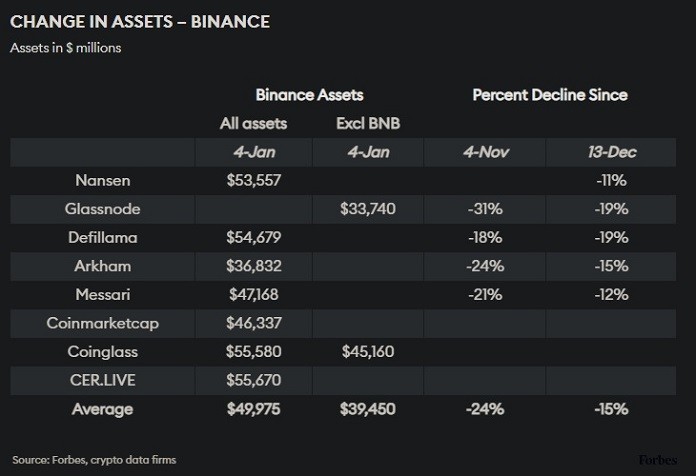

According to the Forbes report, there is a lot of cash outflow from Binance, and there are discrepancies between the assets presented in the proof of reserve report and the actual number of assets. The exchange’s assets decreased by 12 billion dollars in less than two months.

Binance is still the cryptocurrency exchange that complies with the regulations, provides the reports they want to law enforcement, and has the largest reserves. Binance, which will likely face a series of public audits in 2023, aims to continue to hold the largest market share.