In a recent blog post, Binance, the largest cryptocurrency exchange in the world, announced its plans to drop support for the Binance USD (BUSD) stablecoin by 2024. As part of this plan, Binance Margin will suspend several trading pairs involving BUSD by early September, followed by their removal from the exchange’s margin market and cross margin market. The exchange has advised users to close all open positions and transfer their assets to avoid potential losses. While the specific reason for delisting the BUSD pairs was not provided, reports suggest that this decision is part of a larger strategy to fully withdraw support for the stablecoin.

Binance to Drop Support for BUSD by 2024

Binance, the largest cryptocurrency exchange in the world, recently announced its plan to withdraw support for the Binance USD (BUSD) stablecoin by 2024. This decision comes as part of a broader delisting process, which includes the removal of eight BUSD trading pairs on the platform. The exchange also stated that it will close users’ positions, conduct an automatic settlement, and cancel all pending orders related to these trading pairs. To avoid any potential losses, Binance has advised its users to close all open positions and transfer their assets from margin wallets to spot wallets.

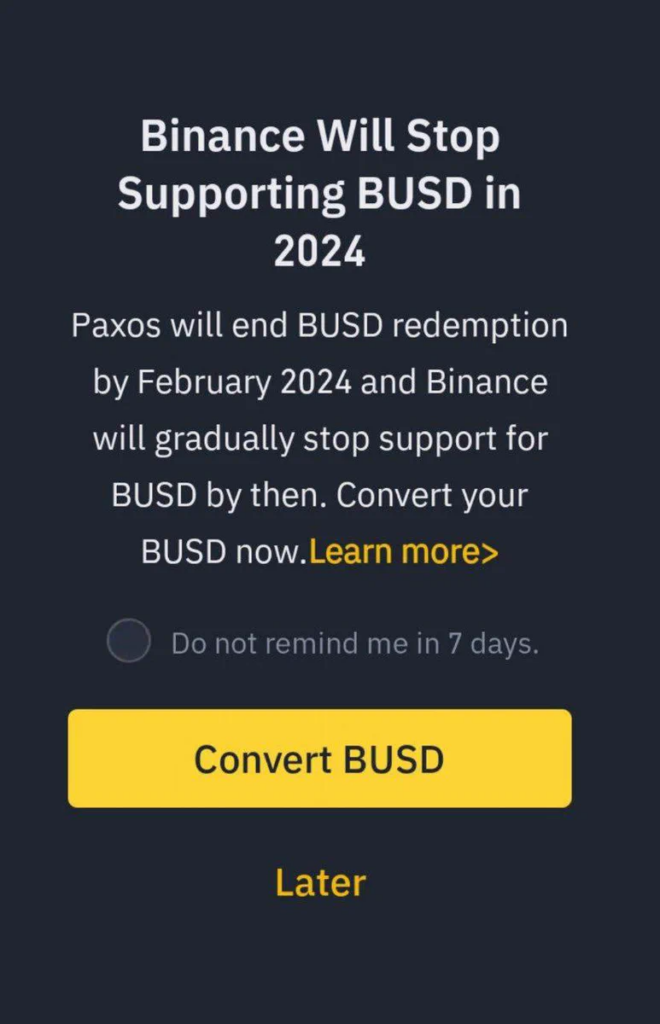

The reason behind the delisting of these eight BUSD pairs is currently unknown. However, there are speculations that this decision is part of a larger plan by Binance to gradually drop support for BUSD by 2024. In a recent pop-up notification to its users, the exchange hinted at this gradual withdrawal of support for BUSD over the next few years. While no specific details were provided, it is clear that BUSD’s future on the Binance platform is uncertain.

Paxos to Cease Support for BUSD by 2024

Another development impacting the future of BUSD is the order issued by the New York Department of Financial Services (DFS) to Paxos, the crypto firm that issues the stablecoin. The DFS ordered Paxos to stop minting BUSD tokens due to unresolved issues related to its oversight of its relationship with Binance. Additionally, the Securities and Exchange Commission (SEC) issued a Wells Notice to Paxos and plans to sue the company over its BUSD issuance, arguing that the stablecoin is an unregistered security.

As a result of these regulatory actions, Paxos announced that it would end its relationship with Binance and stop issuing new BUSD tokens. However, the company will continue to support and redeem BUSD tokens until at least February 2024. In light of these developments, Binance has advised its users to convert their BUSD to other stablecoins before the Paxos deadline. The exchange specifically promoted the First Digital USD (FDUSD) stablecoin as an alternative, offering zero trading fees for trading BUSD to FDUSD.

BUSD Market Performance

The regulatory clampdown on BUSD has had a significant impact on its market performance. Since February, BUSD’s market cap has dropped by over 80%, falling from $16.13 billion to its current value of $3.1 billion. This decline is a result of the regulatory actions taken by the DFS and SEC, which have raised concerns about BUSD’s compliance with regulatory requirements.

In contrast, Tether (USDT), the largest stablecoin in the market, has seen its market capitalization reach a new record high, exceeding $83.2 billion. This milestone marks a recovery of the $20 billion in market value that Tether had lost following the collapse of rival stablecoin TerraUSD last year. The disparity in market performance between BUSD and USDT highlights the challenges and risks faced by stablecoins in the regulatory landscape.

To pave the way for the eventual withdrawal of support for BUSD, Binance has introduced a new stablecoin called First Digital USD (FDUSD). FDUSD was launched in June by the Hong Kong-based trust company First Digital Group and made its debut listing on Binance. In light of the upcoming delisting of BUSD pairs, Binance encouraged its users to trade or convert their BUSD balances to FDUSD.

The exchange even offered zero trading fees for trading BUSD to FDUSD, incentivizing users to make the switch. While the details of FDUSD’s features and benefits were not explicitly mentioned, its availability on Binance suggests that the exchange sees it as a viable alternative to BUSD.

Regulatory Clampdown on BUSD

The regulatory clampdown on BUSD, initiated by the New York DFS and supported by the SEC, has raised significant concerns about the stablecoin’s compliance with regulatory requirements. The DFS’s order for Paxos to stop minting BUSD tokens highlights the unresolved issues related to the oversight of its relationship with Binance. This order was followed by the SEC’s Wells Notice and its intention to sue Paxos over the issuance of BUSD, claiming that it is an unregistered security.

These regulatory actions have undoubtedly had a negative impact on BUSD’s market cap, which has declined by over 80% since February. This decline reflects the challenges faced by stablecoins in navigating regulatory requirements and maintaining their market performance.

Comparison with Tether (USDT)

While BUSD’s market cap has experienced a significant decline, Tether (USDT), the largest stablecoin in the market, has seen its market capitalization reach new record highs. Currently standing at over $83.2 billion, USDT has managed to recover the $20 billion in market value it had lost following the collapse of TerraUSD.

This comparison between BUSD and USDT highlights the contrasting fortunes of stablecoins in the current market landscape. While BUSD has faced regulatory challenges and a decline in market cap, USDT has not only recovered its losses but also achieved new milestones in terms of market capitalization.

BUSD Delisting Procedure

As part of Binance’s plan to withdraw support for BUSD, the exchange will delist eight BUSD trading pairs on September 7. These trading pairs include AMB/BUSD, DASH/BUSD, FIDA/BUSD, HARD/BUSD, HOT/BUSD, IOST/BTC, NULS/BUSD, PORTO/BUSD, and REQ/BUSD. The removal of these trading pairs from both Binance’s isolated margin market and cross margin market signifies a significant step in the delisting process.

To facilitate the delisting procedure, Binance has advised its users to close all open positions and transfer their assets from margin wallets to spot wallets. This precautionary measure aims to minimize potential losses for users during the closure of these trading pairs. Additionally, the exchange will conduct an automatic settlement and cancel all pending orders related to these BUSD pairs by September 9.

BUSD Support Continues until 2024

Despite Binance’s plan to withdraw support for BUSD, Paxos will continue to support and redeem BUSD tokens until at least February 2024. This extension provides users with sufficient time to transition their BUSD holdings to other stablecoins before the support for BUSD is completely discontinued.

To ensure a smooth transition, Binance has encouraged its users to convert their BUSD holdings to other stablecoins prior to the deadline. This proactive approach aims to prevent any disruptions or inconveniences for users as they navigate the changes in BUSD support.

Reason for BUSD Delisting

While Binance’s decision to delist eight BUSD trading pairs and eventually withdraw support for BUSD by 2024 is clear, the specific reason behind this move remains unknown. The exchange has not provided any details or explanations regarding the motivation behind the delisting decision.

Speculations suggest that this delisting may be part of a larger plan by Binance to fully drop support for BUSD by 2024. However, without official confirmation or specific statements from the exchange, the reason behind the delisting decision can only be subject to speculation.

BUSD Market Performance

The decline in BUSD’s market cap since February has been significant, dropping over 80% in value. This decline reflects the challenges and uncertainties surrounding BUSD due to the regulatory clampdown initiated by the New York DFS and the SEC.

On the other hand, Tether (USDT), the largest stablecoin in the market, has experienced a different trajectory. Its market capitalization has reached a new record high, exceeding $83.2 billion. This contrast in market performance between BUSD and USDT highlights the varying fortunes of stablecoins in the current market landscape.

In conclusion, the recent announcements regarding the delisting of BUSD trading pairs and the withdrawal of support for BUSD by Binance raise questions about the future of this stablecoin. The regulatory challenges faced by BUSD, as well as the contrasting market performance between BUSD and USDT, create a complex landscape for stablecoins in the cryptocurrency market. As users navigate these changes, Binance has provided guidance and alternatives such as the FDUSD stablecoin to facilitate the transition away from BUSD.