By Jonny Fry

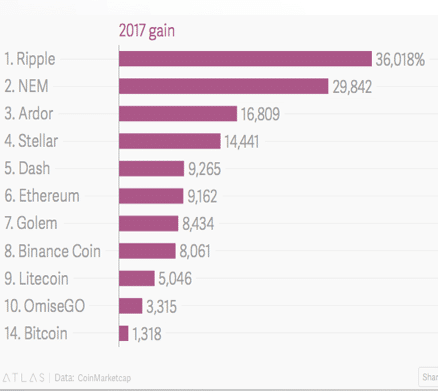

There has been much written about Initial Coin Offerings (ICOs) and the tokens that they create. Many people, when you mention ICOs or cryptocurrencies, start by talking about Bitcoin and how it is not for them as they are not drug dealers, money laundering, or trying to carry out some other illegal activity. Once people start to understand there is more to tokens than just Bitcoin, and they see the massive returns that some have achieved over the last year, fear and greed usually kick in: fear that they are missing out and greed as they want to make money. After all, who would not want to have made 36,000% in a year, which is what Ripple token holders made in 2017?

Below is a chart showing the extraordinary gains the ten best tokens made in 2017 compared to Bitcoin.

Interestingly, Ripple is backed by 100 of the world’s biggest banks as it potentially could be cheaper than SWIFT, the system used by banks to transfer trillions of $,£,Yen and Euros a day between themselves. This illustrates how and why institutions are beginning to take this New Asset Class more seriously.

There are over 1,500 tokens that have been issued from many countries around the world. While, initially, investors have been attracted by the frothy speculative gambling on the next Bitcoin or Ripple, it is a very small part of the real opportunity for private and public companies and governments. Much attention has been focused on ICOs being used to raise capital and in 2017 they raised over $5.7 billion (Source CB Insights Token Data).

Now we are seeing governments turning their attention to cryptos with the recent announcement that Turkey and Iran are looking to launch a token as a way to create a more efficient currency incorporating the benefits it offers to tackle fraud and reduce the impact of the ‘black economy’. Closer to home, Mark Carney at The Bank of England has been open about talking to a number of central banks globally about Digital Currencies

This is all rather ironic as what started as a way to carry out anonymous transfers often on The Dark Web can potentially help crush a country’s black market economy.

Further institutional interest in ICOs and cryptos has been seen by Quoted companies in USA, Canada, Germany and Spain all announcing their involvement with ICOs.

I suspect it will not be long before we see Amazoncoin, Facecoin, Starbuckscoin; not for these firms to raise capital but as a new type of Digital Loyalty Scheme designed to keep the attention and engagement with customers. After all, loyalty programs are already a multi-billion market already.

Such schemes are a way to attract customers’ attention and reward them for the purchases they make or the time they spend on their website. Loyalty programs like American Express or Air Miles, even paper-based ones such as buy ten Stabuck’s coffees and get the next one free, have been around for years. Tokenising such schemes and giving them the ability to be traded 24/7 is increasingly being seen as a must-have in many corporate marketing departments.

Food for thought!

Jonny Fry CEO www.TeamBlockchain.net

February 2018

Image from pixabay here.