Price Action

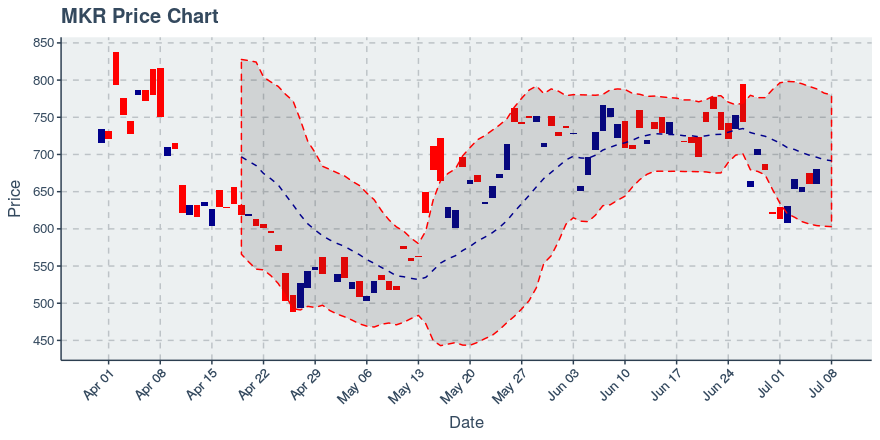

In the week prior, the price for Maker went up by 12.62%. It is below its 20 day moving average by 0.03%, which is quite close. Maker’s bullish momentum, determined by its distance from its 20 day moving average, is roughly middle-of-the-pack relative to the cryptos we’re tracking. Regarding volatility, Maker is more volatile than roughly 30% of coins in our index, so it’s notably less volatile than the other cryptocurrencies we’re monitoring. Based on volatility over the past three weeks, we can expect Maker to experience a price range in US dollars between 603.3367 and $778.6343.

Where to trade Maker (symbol: MKR): Gate, Yobit, DDEX, Ethfinex

Volume Update

Over the past week, Maker saw its daily volume range between 6,549.603 and 198,835 units of its own currency. Over the past three weeks, the trend in volume does not have a clear direction, while the price trend is clearly down. The past 7 days saw Maker’s trading turnover — meaning the percentage of its available supply that was traded — come in at 11.94%. Its turnover rate is more than approximately 87.25% of the cryptocurrencies in our index, so it’s far above average and thus a good coin for those interested in active trading or being able to get out of the market if they need to.

Engagement Update

Maker saw the number of wallets holding its coin go from 12,837 to 13,082 over the past week — a change of 1.91%. And in regards to cumulative transactions logged on the blockchain, they went from 384,284 to 392,995, which amounts to a change of 2.27%. This translates to a combined engagement growth rate of 4.18% for Maker — which is higher than 67.65% of the cryptocurrencies we’re reporting on. This could indicate that the coin’s engagement is growing at an above average rate.

Technology Development Status

At the moment, Dai has 60 repositories open to the public on GitHub, with the oldest one now being 3.84 years young. The last recorded update to its public repositories was within the past day, which is pretty good, as it suggests the coin is still under active and rapid technical development. Dai’s public repositories collectively have a total of 1042 watchers, which is pretty good, relatively speaking; specifically, that’s more than 70 % of the top 100 coins we’re looking at. The coin has 100 total outstanding issues across all 60 of its public repositories on GitHub. Its number of watchers, when viewed against its open issues count, is fairly mediocre. We consider the GitHub open issue/watcher ratio as a potential indicator of the healthiness of a coin’s software development process, and for Dai we see that its issue/watcher ratio looks healthier than 48% of similar coins in our index.

Maker News and Commentary

We found 3 links over the past week about Maker that we thought were especially worth sharing. If possible we included a brief excerpt from the article — be sure to click through for the entire piece.

Hate Twitter? OutBox Is a Raspberry Pi Device That Will Tweet

8 platforms to find early adopters for your p

Katrin Reifeiss – Cotton & Moss

Where to Buy

You can trade Maker, listed under the symbol MKR, through the following exchanges: Gate, Yobit, DDEX, Ethfinex.

Article by SixJupiter