In a bold move to address the burgeoning US national debt, Senator Cynthia Lummis has reiterated her proposal for a Bitcoin reserve. This suggestion comes in the wake of the Treasury Department’s announcement that the US gross national debt has surpassed $35 trillion for the first time, a stark contrast to the $907 billion debt level four decades ago.

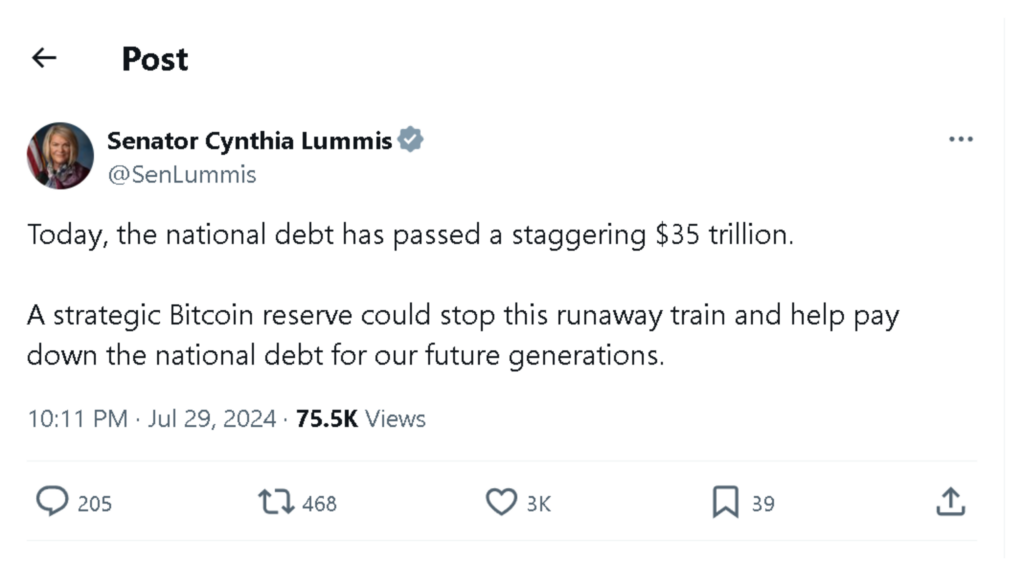

Senator Lummis believes that establishing a strategic Bitcoin reserve could help mitigate the rising national debt and secure a brighter economic future for coming generations. She voiced her proposal on X, highlighting the potential of Bitcoin to halt the runaway debt train and contribute to national financial stability.

According to Fox Business, Lummis has been quietly crafting a bill that would require the Federal Reserve to maintain Bitcoin as a strategic reserve asset. She unveiled the specifics of this bill at the Bitcoin 2024 conference, suggesting the acquisition of one million Bitcoins over a five-year period for a government reserve. This digital asset reserve, she argues, could significantly reduce the national debt.

Under the proposed plan, the Bitcoin would be held for at least two decades. The Federal Reserve and the Treasury would reallocate existing funds to finance the acquisition. Lummis asserts that this measure would secure the dollar’s position as the world’s reserve currency, stating, “Families across Wyoming and the US are struggling with soaring inflation and record-breaking costs. Now more than ever, we need to diversify into Bitcoin to secure our economic future.”

At the same conference, Republican presidential nominee Donald Trump discussed the US’s current Bitcoin holdings. While he did not commit to establishing a strategic Bitcoin reserve, Trump promised to retain the existing Bitcoin assets acquired through asset seizures.

The idea of a Bitcoin reserve is not just about debt reduction; it is also about enhancing the stability and global dominance of the US dollar. By integrating Bitcoin into the national reserve, the US could diversify its financial assets and hedge against economic uncertainties. This move could potentially attract more international investments, as Bitcoin’s decentralized nature and finite supply make it an attractive asset for long-term holding.

However, there are significant challenges and considerations. The volatility of Bitcoin is a major concern. Its price fluctuations could impact the overall value of the reserve, making it a risky asset compared to traditional reserves like gold. Additionally, the logistics of acquiring and securely storing such a large quantity of Bitcoin would require careful planning and robust cybersecurity measures.

Furthermore, the political and public acceptance of Bitcoin as a reserve asset could face resistance. Many policymakers and financial experts remain skeptical about cryptocurrencies, citing regulatory concerns and the lack of intrinsic value. Gaining widespread support for this proposal would necessitate extensive advocacy and education about the potential benefits and risks of Bitcoin.

Senator Lummis’s proposal for a Bitcoin reserve is a forward-thinking approach to addressing the US national debt and securing the dollar’s global position. While the idea is ambitious and carries inherent risks, it opens up a new avenue for financial innovation and diversification. As the US navigates its economic challenges, integrating Bitcoin into the national reserve could be a step toward a more resilient and diversified financial future.