Key highlights:

- BTC closed March with a price of $28,450, and investors expect it to reach $30k in the first week of April.

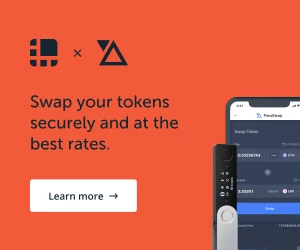

- However, Bitcoin’s Social Volume and Social Dominance indicators are at their highest level in the past 12 months, and the Fear & Greed Index indicates that investor appetite is increasing.

- Bitcoin price has been above the 20-day EMA since March 13, and some analysts think it could reach $30k after dropping to $27.7k.

There are hundreds of on-chain analysis methods that can be used to predict Bitcoin price. Santiment, one of the most well-known crypto analytics companies in the market, evaluated the current situation of Bitcoin in a blog post it published the other day. Using five indicators, Santiment tries to predict the trend in the near future.

BTC closed in March with a price of $28,450. Investors expect it to reach $30k in the first week of April. However, Santiment says that the trading volume is starting to drop, meaning the bulls are tired. This is a harbinger of rising volatility. A few positive news could lead the BTC price to climb above $30k.

On the other hand, Bitcoin’s Social Volume and Social Dominance indicators are at their highest level in the past 12 months. Social Dominance is an indicator that refers to social media posts about Bitcoin.

In addition, we are currently in the greed zone with 61 on the Fear & Greed Index. This indicates that investor appetite is increasing and new investors are entering the market. According to this indicator, the BTC rally should continue.

Long-Term Holders

An indication of the decline is that long-term BTC holders are starting to become active. Especially since March 10, there is increasing activity. Investors may need some cash or be uncomfortable with the regulatory situation in the US.

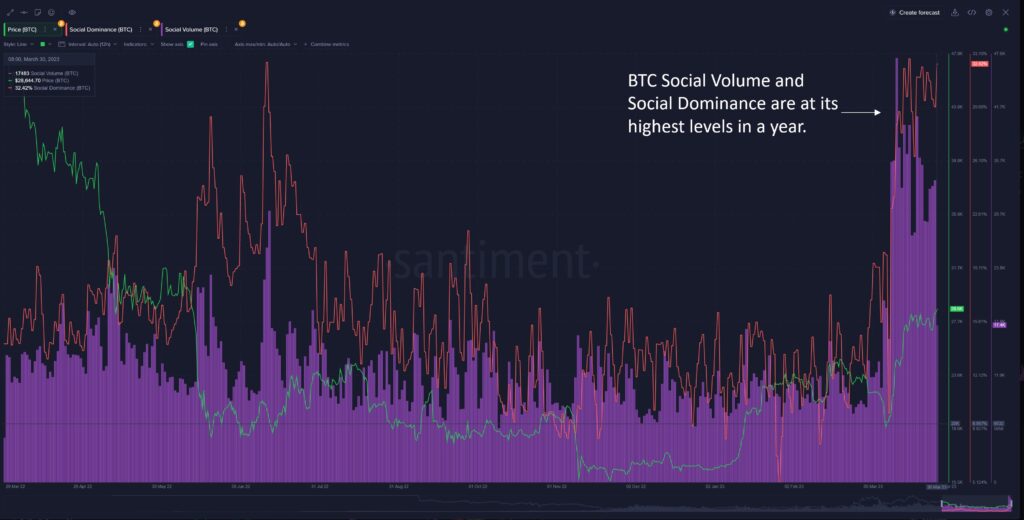

Investors are consistently borrowing WBTC from DeFi lending & borrowing protocol Aave. We can see that WBTC borrowing volume has skyrocketed in November’s local bottom. The fact that this chart is rising again, albeit slowly, shows that investors are selling BTC shortly.

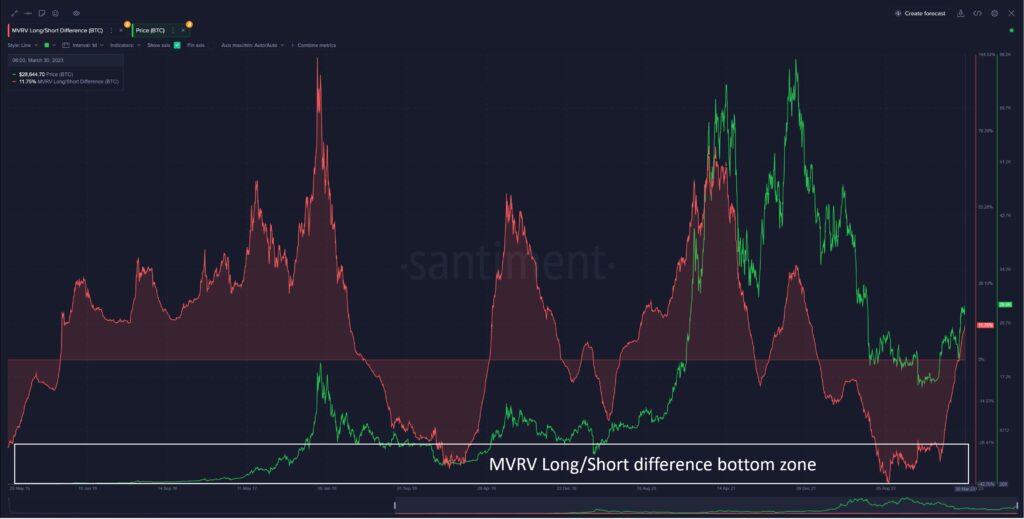

Bitcoin’s market-value-to-realized-value (MVRV) ratio charts are similar to 2019. This indicator is not fully valid due to the very different macroeconomic conditions at the moment.