Key highlights:

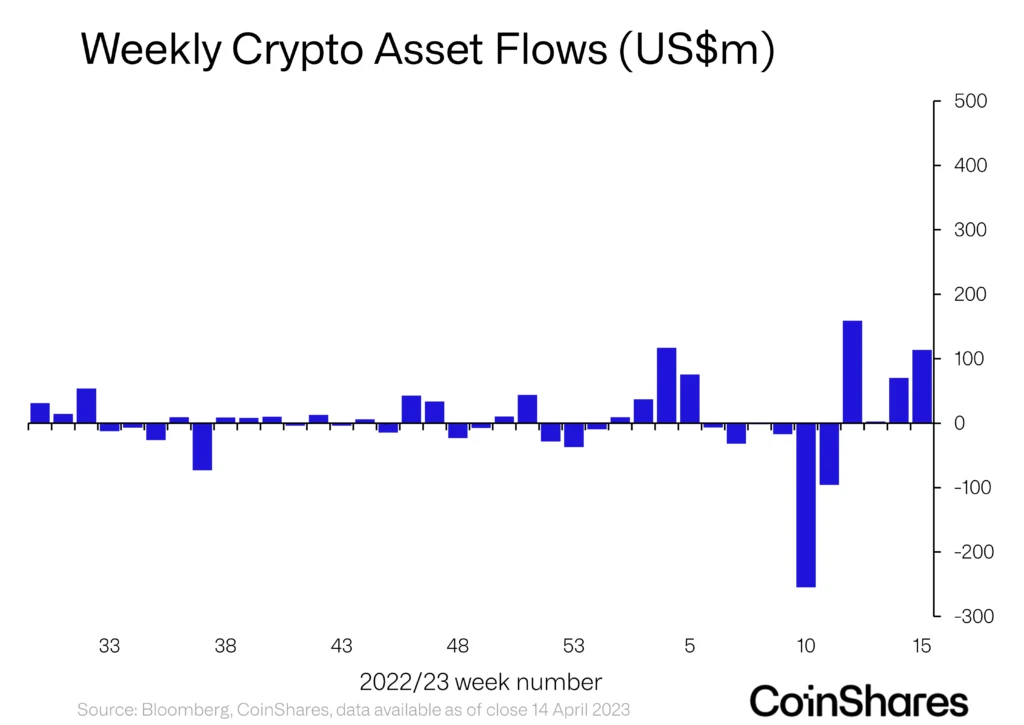

- Over the past four weeks, net inflows into digital asset mutual funds have totaled an impressive $345 million.

- Meanwhile, investments in “Short Bitcoin” funds, which bet on Bitcoin’s decline, saw an influx of $14.6 million last week.

- The USA and Germany lead the charge in digital asset fund investments, with Grayscale dominating the $35.7 billion digital mutual fund market, holding $25.8 billion.

While the recent price appreciation of the largest cryptocurrency may have sparked additional interest from speculators, the steady and continual inflow hints at the gradually maturing sentiment among long-term investors.

In the past week, digital asset mutual funds have seen a net inflow of a whopping $114 million, taking the net inflow over the last 4 weeks to an impressive $345 million! Bitcoin funds are the star of the show, accounting for a massive $103.8 million of that investment.

While Ethereum’s Shapella upgrade was successful, investments in the world computer’s funds were lacking at a paltry $300,000.

2023 Is A Dream For Bitcoin So Far

2023 is turning out splendid for Bitcoin with $78 million net inflows, unlike Ethereum still struggling at $23 million outflows.

But here’s an interesting twist: despite the rise in crypto, especially Bitcoin, investments in “Short Bitcoin” funds haven’t slowed down. Last week alone saw an influx of $14.6 million into these funds betting on Bitcoin’s decline.

Funds for Litecoin, XRP, and Cardano also saw investments of $200K, $100K, and $100K respectively.

USA and Grayscale Leads in Funding

When it comes to countries leading the charge in digital asset fund investments, the USA and Germany take the cake, with $58.5 million and $35.4 million invested, respectively. Canada came third at $17.2 million.

The leader in enabling access for traditional investors remains Grayscale. It’s worth mentioning that Grayscale continues to dominate the $35.7 billion digital mutual fund market, holding a staggering $25.8 billion.

While volatility remains, interest in crypto funds grows more robust by the week. Though uncertainties remain, cryptocurrencies appear poised to claim a more prominent role in investment portfolios.